Spain’s property market has long attracted international buyers, with its warm climate, cultural richness, and investment potential offering a compelling draw. Buying property on Gran Canaria, in particular, remains a strong market for foreign investment, thanks to its stunning coastline, year-round tourism, and vibrant foreign-resident communities. However, significant changes are afoot in Spain’s property laws, with proposed legislation aiming to restrict non-resident, non-EU buyers from continuing to drive up property prices.

Read on to learn more about some of the dynamics of Spain’s real estate market, the implications of the upcoming regulations, and how these changes may shape property ownership on Gran Canaria and beyond.

The Real Estate Boom: Tourism and Its Impact

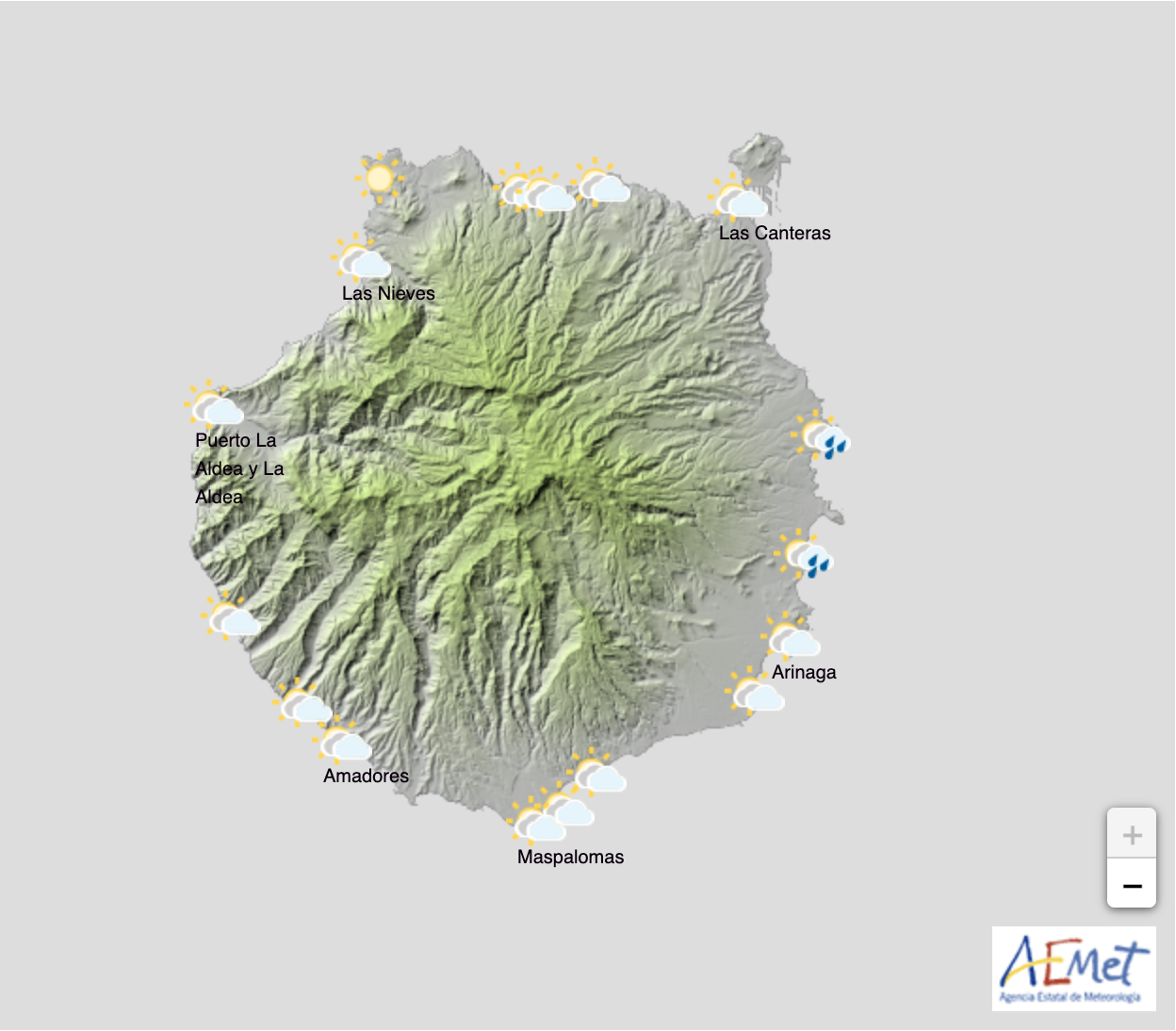

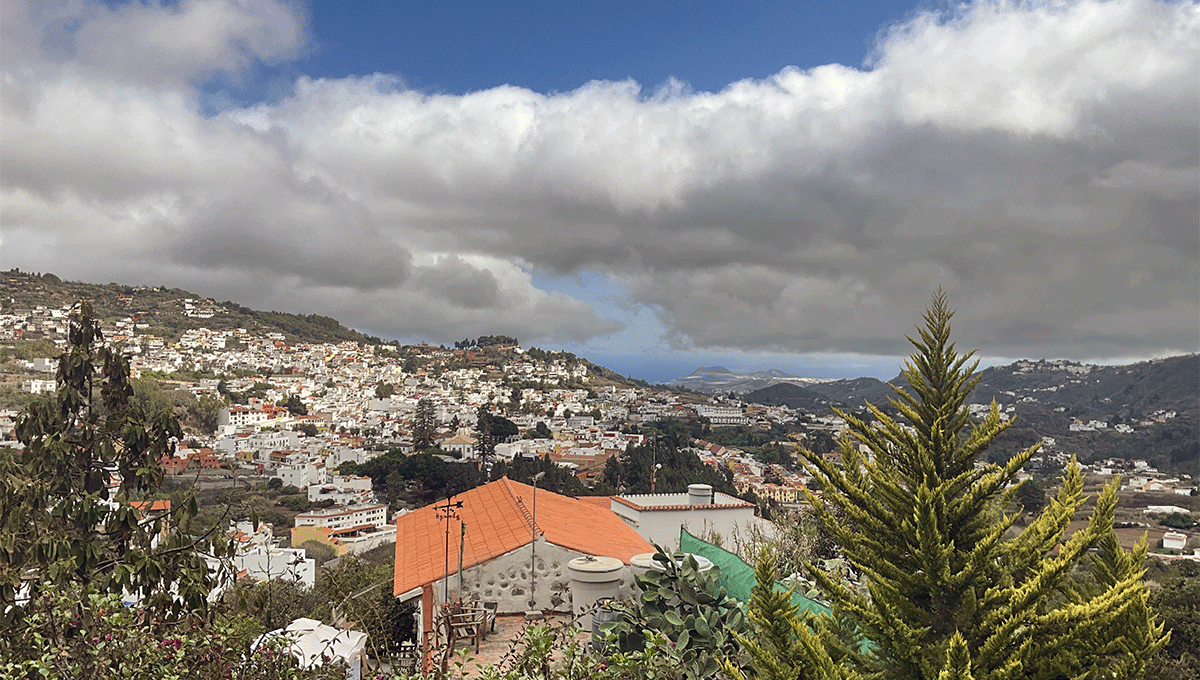

Gran Canaria and other popular regions in Spain, such as the Balearic Islands and Costa del Sol, have witnessed skyrocketing property prices over the past decade. Tourism has been a double-edged sword: while it has bolstered the local economy, it has also strained the housing market.

In some of the more popular parts of Spain, and particularly in the capital city, and tourist resort towns, here on Gran Canaria, locals complain that they simply can no longer get on the property ladder and to do so would require them moving away from their families and the places in which they grew up. There have been protests, accusing successive governments from turning a blind eye to the plight of the native population in preference for, what they say has been, uncontrolled property speculation by large companies hoping to profit and foreigners with much greater purchasing power.

In some of the more popular parts of Spain, and particularly in the capital city, and tourist resort towns, here on Gran Canaria, locals complain that they simply can no longer get on the property ladder and to do so would require them moving away from their families and the places in which they grew up. There have been protests, accusing successive governments from turning a blind eye to the plight of the native population in preference for, what they say has been, uncontrolled property speculation by large companies hoping to profit and foreigners with much greater purchasing power.

Tourism is great, they say, if done the right way, but should not be at the expense of local communities. What benefits there are for your average Spaniard, by way of employment and increased tax revenues for public services, these are far out weighed the diminishing housing for locals who want to live and work in their own towns and regions.

Data shows that over the first nine months of 2024, property prices across Spain rose by an average of 9% year-on-year. This trend has been particularly pronounced in tourist hubs, where foreign buyers dominate. On Gran Canaria, the influx of non-resident investors has driven up demand for coastal properties, luxury villas, and holiday homes.

Tourism as a Driving Force

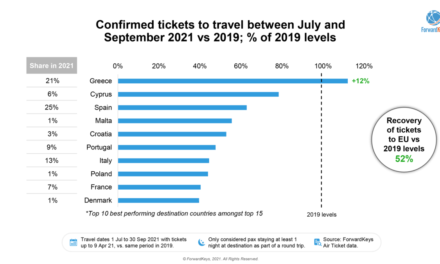

In 2024, Spain welcomed 94 million tourists, a record high. Gran Canaria’s mild climate makes it a prime destination, particularly for northern Europeans seeking refuge from harsher winters. Airbnb and other short-term rental platforms have also spurred a rise in holiday home investments. While this boosts rental yields for property owners, it has led to significant housing shortages for locals.

Gran Canaria welcomed 4.3 million tourists in 2024. This figure reflects its continued popularity as a year-round destination, contributing significantly to the Canary Islands’ total of approximately 15 million tourists that year. Tourism remains a key driver of the island’s economy, with strong demand from European markets like Germany and the UK.

This backdrop has prompted policymakers to scrutinise the real estate market, pushing forward new regulations to prioritise affordable housing for residents.

Proposed Legislation: Timelines and Key Objectives

What Is Changing?

The Spanish government has announced a bold proposal: imposing an up-to-100% tax on property purchases by non-resident, non-EU citizens. The policy is expected to primarily affect second-hand properties, as new-build homes continue to fall under EU VAT rules, which Spain cannot unilaterally alter. This measure forms part of a broader strategy to stabilise housing prices and deter speculative investment.

Why Now?

The timing of this legislation is tied to growing public pressure. Rising property prices have sparked protests across Spanish cities, with residents demanding better access to affordable housing. The government’s move reflects a political commitment to addressing this crisis head-on.

Implementation and Effectiveness

The proposed tax is still under review and faces several hurdles:

- Legal Challenges: Experts have highlighted that the tax may conflict with EU laws, particularly those protecting the free movement of capital.

- Regional Variations: Property taxes in Spain are set by autonomous communities. Regions like the Canary Islands may resist implementation, potentially delaying the rollout.

- Economic Risks: Critics argue that discouraging foreign buyers could harm local economies reliant on real estate investments and tourism.

Should the tax be approved, it is likely to take effect in 2025 or early 2026, with an immediate impact on non-resident buyers.

Despite these legislative uncertainties, buying property on Gran Canaria continues to offer significant advantages for foreign investors. The island’s appeal lies in its diversity: pristine beaches, mountainous landscapes, and vibrant urban centres like Las Palmas. Gran Canaria’s property prices, while rising, remain competitive compared to other regions in Spain. In H1 2024, the average price for properties in the Canary Islands was €2,534/m²—significantly lower than the Balearics (€4,492/m²) and Madrid (€3,245/m²). The island’s booming tourism industry ensures high rental demand, particularly for short-term holiday homes. For buyers looking to capitalize on this market, properties near Maspalomas or Puerto de Mogán offer excellent returns. Gran Canaria’s infrastructure, safety, and quality of life make it a haven for retirees, digital nomads, and families. The island boasts international schools, robust healthcare, and a thriving expat community, particularly in the southern resorts. Why Gran Canaria Remains a Top Choice for Buyers

Why Gran Canaria Remains a Top Choice for BuyersAffordable Compared to Other Hotspots

Strong Rental Yields

Quality of Life

Breaking Down the Current Proposals

Scope of the Tax

Scope of the Tax

The proposed 100% tax applies only to non-EU, non-resident buyers. This group represents a small but significant portion of the market—approximately 1.69% of total transactions in 2024.

Impact on Specific Groups

- British Buyers: Post-Brexit, UK citizens are classified as third-country nationals. This makes them subject to the proposed tax, potentially doubling their purchase costs.

- Non-European Buyers: Emerging markets, such as Morocco and Ukraine, may also face barriers, dampening their growing interest in Spain.

Exemptions and Loopholes

The tax does not apply to new-build properties, offering a potential pathway for non-residents to invest without incurring the surcharge. Additionally, buyers who establish legal residency in Spain could avoid the tax entirely.

Market Outlook: Challenges and Opportunities

Challenges for Buyers

Challenges for Buyers

For non-resident investors, the legislative changes add a layer of complexity to property ownership in Spain. The higher costs may deter casual buyers, but seasoned investors are expected to adapt by focusing on new-builds or residency options.

Opportunities for Locals

The government hopes the measures will ease pressure on housing availability, enabling more locals to afford homes in previously unattainable areas.

Expert Opinions

Real estate professionals remain divided on the policy’s impact. “While the tax may curb speculative buying, its long-term effects on the market remain uncertain,” said Judit Montoroil Garriga, CaixaBank’s chief economist.

Timing Your Investment

If you’re considering buying property on Gran Canaria or elsewhere in Spain, timing is critical. With the proposed tax still under discussion, acting sooner rather than later may be advantageous. Similar policy announcements, such as the phasing out of “golden visas,” have historically led to short-term surges in property transactions.

Final Thoughts: A Balanced Perspective

Final Thoughts: A Balanced Perspective

While the Spanish government’s proposed tax marks a significant shift, it reflects an effort to balance the interests of foreign investors and local residents. For buyers, understanding the nuances of this legislation—and acting strategically—can help navigate these changes effectively.

Gran Canaria remains a promising destination for property investment. By focusing on regions with stable demand and exploring options like new-build homes, foreign investors can still find value. At the same time, locals may finally see some relief as policies begin to address affordability.

Whether you’re seeking a holiday retreat, an investment opportunity, or a permanent home, Gran Canaria’s unique charm ensures it remains at the heart of Spain’s property market.

Further Reading

Record Foreign Purchases in Spain Boost Market to New Highs in 2024

Source: Idealista News, 26 November 2024

Spain’s real estate market experienced a record-breaking first half of 2024, driven by increased foreign investment. Key highlights from the report include:

Record Property Purchases

- Foreigners purchased 69,412 properties in H1 2024, a 1.8% increase from 2023, accounting for 20.4% of all transactions.

- Foreign residents drove the growth, completing 40,389 transactions (+4.2%). Non-residents saw a slight decline (-1.4%), with 29,023 purchases.

Leading Nationalities and Trends

- The British maintained their position as the top foreign buyers (8.4% of total foreign purchases), followed by Moroccans (7.9%) and Germans (6.8%).

- Eight nationalities, including buyers from the USA, Portugal, Italy, and Ukraine, reached record transaction levels in H1 2024.

- The war in Ukraine and currency advantages contributed to sharp increases in purchases by Poles (+28.5%) and Ukrainians (+20.8%).

Regional and Price Records

- The Valencian Community led with 21,224 transactions, making up 30% of all foreign purchases, followed by Andalusia (12,637) and Catalonia (10,465).

- The average price per square meter for properties purchased by foreigners hit a historic high of €2,249/m², a 7.4% year-on-year increase.

- Non-resident foreigners paid significantly more (€2,895/m², +11.4%) compared to resident foreigners (€1,734/m², +3.4%) and Spanish buyers (€1,659/m²).

- The Balearic Islands recorded the highest average prices (€4,492/m², +14.2%), followed by Madrid (€3,245/m²) and the Canary Islands (€2,534/m²).

Declines in Key Markets

- Purchases by Russian buyers fell sharply (-24.2%), with declines also seen among Norwegians (-17%), French (-15.5%), and Belgians (-8.8%).

- The Canary Islands saw an 11.1% decline in transactions despite maintaining high price levels, indicating shifts in foreign interest.

Implications

The data underscores Spain’s enduring appeal as a property investment destination, despite rising prices and regional disparities. While British buyers remain dominant, growing demand from emerging nationalities like Poles and Moroccans suggests a diversification in the market’s foreign clientele.

For further details, read the original article on Idealista News.