Recent developments may well impact those British property purchasers with more than half a million euros to spend, who were hoping to bypass many of the post-Brexit hurdles to coming to live in Spain, as the Spanish government has signaled its intention to phase out the “golden visa” program following a significant spike in the number of visas granted over the past two years. Data released by the Ministry of Housing on Tuesday highlights an increase, with 3,273 authorisations processed in 2023 up from 2,017 in 2022, with less than a thousand annually recorded in previous years. This surge represents a 230% jump from the 997 permits issued in 2021 to 2023.

The “golden visa” program, in effect since 2013, offers residency permits to non-EU nationals who make substantial investments in Spain. These investments include purchasing real estate worth over half a million euros, investing two million euros in Spanish public debt securities, or placing one million euros in shares of Spanish companies, investment funds, or bank deposits. The program has primarily benefited citizens from China and Russia, followed by individuals from Iran, the USA, and Britain. Visas are valid for five years, renewable, and do not require holders to reside in Spain for renewal.

This move to eliminate the “golden visa” scheme has not secured unanimous support within the government’s coalition partners, indicating potential hurdles in the legislative process.

The decision comes amid concerns over real estate speculation fueled by the visa program, as well as second home purchases, notably in urban areas like Barcelona, Madrid, and Málaga, which, along with Alicante, the Islands, and Valencia, account for 90% of the “golden visas” issued. The Ministry of Housing reports that property purchases linked to the program have comprised up to 7.1% of annual real estate transactions in Marbella and 5.3% in Barcelona, though we have yet to see data regarding purchases in The Canary Islands.

Over the decade-long span of the program, transactions aimed at securing “golden visas” have totaled 10 billion euros, with average investment amounts showing a downward trend from 2.5 million euros in 2017 to just 747,785 euros in the current year. The suggestion is that more golden visas are now sought for house purchases than other types of investment.

The surge in “golden visa” issuances, now reaching a total of 10,528 compared to the 6,200 previously reported by the Ministry of Foreign Affairs and Transparency International, has prompted the Spanish government to reconsider the scheme. Minister Isabel Rodríguez emphasized the role of speculative investment in the exponential increase of these visas in recent years, marking a pivotal moment for Spain’s approach to foreign investment and residency.

“Golden Visa” turnaround in Housing Rights Push

In a decisive move towards ensuring housing as a fundamental right rather than a speculative venture, Spanish Prime Minister Pedro Sánchez announced the plans to abolish the “golden visa” program on Monday, followed by a council of ministers press conference this Tuesday.

The scheme, which grants residency to non-EU nationals investing over €500,000 in Spanish real estate, has been criticised for inflating property prices and sidelining affordable housing. Sánchez’s announcement preempted a crucial Cabinet meeting scheduled to review a report aimed at revising the law enabling these visas. “We are going to eliminate the ‘golden visa’ to ensure that housing is a right and not merely a speculative business,” Sánchez stated, emphasising a departure from speculative investment models in the housing sector.

This initiative aligns with the government’s broader housing strategy, which has seen a historic investment in the sector. With a budget that has surged from €473 million in 2018 to €3.472 billion in 2023, the focus is on increasing affordable housing availability and tackling rent market speculation. The government’s efforts include the first Housing Law of democracy, the promotion of affordable construction, and financial measures supporting young and low-income families in acquiring their first homes.

Sánchez called for municipal and regional governments to bridge the gap with the European average in public housing availability.

“Our goal is clear: to fulfill the constitutional right to decent housing for all,” Sánchez affirmed. This legislative period is envisioned as a turning point, positioning housing as a cornerstone of Spain’s welfare state.

As the Spanish government gears up to formalize this shift in policy, the move is seen as a significant step toward reorienting the housing market towards sustainability and inclusivity, moving away from its speculative past.

Spain is poised for significant changes in its property market and housing policies, heralded by the government’s latest moves to address speculation and affordability. At the forefront of these changes is the proposed abolition of the “golden visa” scheme, a decision that reflects a broader commitment to making housing more accessible and less of a commodity.

The Golden Visa Scheme Turnaround

Introduced in 2013, the “golden visa” program allowed non-EU nationals to gain residency in Spain through a minimum investment of €500,000 in real estate. Targeted primarily at boosting the economy, the scheme has seen a total of 14,576 visas issued, attracting significant investment from countries like China, Russia, the UK, and the US. However, with investment hotspots like Barcelona, Madrid, and Málaga seeing the bulk of these transactions, concerns over housing speculation and its impact on local markets have intensified.

In Prime Minister Pedro Sánchez’s announced intention to discontinue the “golden visas” he says his government want to ensure “housing is a right and not merely a speculative business.” This move signals a significant policy shift towards prioritising affordable housing and sustainable urban development. For many Spanish citizens the need to reform the housing market is seen as a real priority especially in areas where large numbers of tourists often consider buying as this has direct effects on the locals and their ability to compete for finite resources in housing stocks, particularly when new affordable housing was not seen to be a priority following the financial crash of 2008. The shift towards a greater emphasis on housing for ordinary Spaniards may be welcomed by much of the population.

Madrid’s Strategy: Enhancing Housing Affordability

Underpinning these developments is a comprehensive strategy unveiled by Housing and Urban Agenda Minister Isabel Rodríguez. The plan encompasses enhancing affordable housing supply, facilitating financing for families and developers, and streamlining construction processes. The abolition of “golden visas” is viewed as a critical first step towards addressing market speculation and ensuring accessibility to housing.

Moreover, Rodríguez highlighted the government’s substantial investment in social rental housing and urban rehabilitation, reflecting a concerted effort to improve housing quality and affordability. This includes the financing of 24,964 social rental homes, exceeding initial targets and marking a significant stride towards expanding the affordable housing stock.

Fostering Social Policies and Sustainable Development

The Spanish government’s commitment extends beyond housing to encompass broader social and sustainable initiatives. These include fostering job creation in the construction sector, enhancing energy efficiency in housing, and deploying substantial financial resources for urban regeneration.

Significantly, Spain is also pioneering in evaluating social inclusion policies through scientific methodology, aiming to enhance the effectiveness of interventions targeting vulnerable populations. This approach underscores a holistic vision for social welfare and urban development, aligning with European standards and commitments.

Challenges and Opportunities

Spain’s challenge in navigating these policy shifts, lies in balancing investment attraction with housing affordability and social inclusion. The abolition of “golden visas” will mark a critical step in this direction, potentially reshaping the property market landscape and setting a precedent for sustainable urban development.

The future of Spain’s housing market and urban policy landscape is at a pivotal juncture. With the government’s commitment to affordability, sustainability, and social welfare, the coming years will likely see transformative changes, impacting not just the property market but the broader socio-economic fabric of the country.

Golden Visa Changes on Gran Canaria’s Property Market Amidst Shifting Foreign Investment Trends

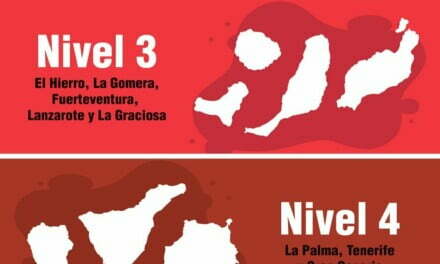

The latest announcements on Golden Visas, which originally designed to attract non-EU nationals through significant real estate investment, mark a pivotal shift in Spain’s approach to foreign property investment. This decision is particularly resonant in the Canary Islands, where Gran Canaria, a jewel in the archipelago, has traditionally attracted a substantial share of foreign buyers, albeit to a lesser extent than its neighbour, Tenerife.

These changes may well be welcomed in The Canary Islands where tensions have grown in recent years due to the lack of affordable housing and what is seen by many as a runaway tourism speculation model that encourages foreign property buyers and in turn prices local workers out of the market. It has recently been recognised too that there are corporate entities who have bought up significant numbers of homes purely as holiday rental investments, reducing the numbers of homes available to ordinary Canarians.

More than a quarter of all house sales in Canaries to foreigners

Since 2012, one in every three homes that has been sold in the Province of Tenerife has ended up in the hands of foreigners (exactly 33.5%), which contrasts clearly with 20.79% of the Eastern Province and leaves a regional average of 26.8% in this period.

The trend in the last twelve years on the Islands has not really been upward or downward, overall, but has experienced what is usually known in statistics as “saw teeth”, with drops and rises in the percentage without excessive contrasts between successive years, although there is more stability in the Eastern Province. However, the highest peak in house purchases by foreigners in the Western Province occurred in 2017, when it reached 40.72%, compared to 22.33% in Las Palmas de Gran Canaria and a 31.35% regional average that year (also the highest regional percentage in these 12 years).

Post-Brexit Surge and Market Dynamics

The market has also seen a notable surge in property purchases by British nationals post-Brexit, seeking to retain some EU privileges. This trend underscores the changing dynamics of Spain’s real estate market, with foreign investment playing a crucial role.

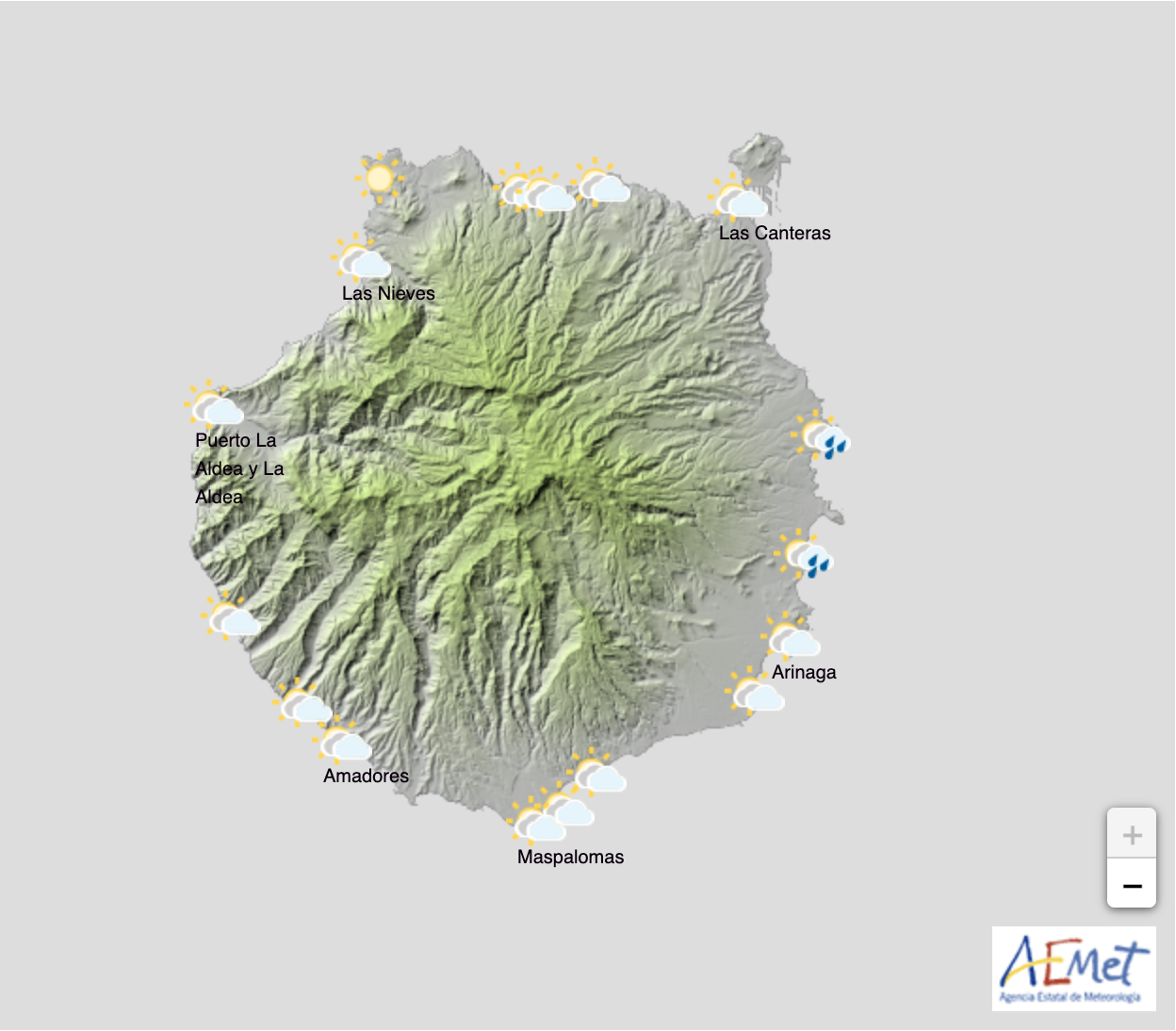

Gran Canaria’s Property Landscape

The Canary Islands have long been a preferred destination for international property investors, drawn by our stunning landscapes, favorable climate, and strategic location. Historical data reveal a pronounced preference for the province of Santa Cruz de Tenerife among foreign investors. However, Gran Canaria has also seen considerable foreign interest, although at varying degrees over the years. Notably, the province of Las Palmas, which includes Gran Canaria, has experienced fluctuating but generally increasing foreign property ownership, with a peak in 2014 at 23.81% of properties sold to foreigners.

The Archipelago is the third autonomous community in Spain where foreigners make the most home purchases. In 2023, according to data from the College of Registrars, non-residents accounted for 28.5% of the transactions (25,258 purchases and sales in total with an average price of 2,265 euros per square meter). That is, almost three out of every ten homes were purchased by foreigners.

In the Canary Islands the Italians, Germans, British, Belgians and Poles stand out, in that order. Registrars warn, however, of a growing number of nationalities that are involved in real estate operations. Regarding the type of home, Italians especially pay attention to those with less than 60 square meters, while the British prefer those with more than 100 square meters.

Although the Canary Islands are one of the favourite destinations for foreigners when it comes to purchasing a home, the truth is that the data does not place the islands as a particularly favoured place for those who invest more than 500,000 euros.

The fluctuations in foreign property purchases in Gran Canaria and the broader Canary Islands reflect a market characterised by “sawtooth” dynamics – periods of increase followed by declines, without a clear long-term trend in either direction. Despite these fluctuations, foreign investment has remained a significant aspect of the local property market.

Foreign Nationalities and Market Preferences

The diversity of nationalities investing in Gran Canaria is notable, with Germans, Italians, and Brits leading the way in recent years. The preferences and investment patterns of these groups have had a noticeable impact on the property market, contributing to the dynamic interplay of supply and demand on the island.

Implications of the Golden Visa Abolition

The “golden visa”, since its inception in 2013, has facilitated a considerable influx of non-EU investment in Spanish real estate, contributing to the housing market’s dynamism but also raising real concerns about affordability and speculative bubbles. Add to that the holiday home market which continues driving up of both rents and sale prices, often making property purchases beyond the reach of most native Canarians, in a region that boasts not only some of the highest levels of tourism in Spain, but also some of the lowest wages of any region in the country and one of the largest numbers of the population suffering from poverty and at risk of social exclusion. In fact the Canary Islands are among some of the most poverty stricken regions in Europe, as well as being a peripheral region, begging the questions of how can the region be both the one most benefitting and most suffering from the rising influx of foreigners, and how to address these challenges while better distributing the benefits?

For Gran Canaria, the abolition of the golden visa poses questions about the future landscape of foreign investment. While the program’s termination may lead to some short-term decrease in high-value transactions from non-EU investors, the long-term effects are bound to be more complex. Gran Canaria’s enduring appeal to European and other investors, coupled with our lifestyle and climate advantages, may well continue to drive foreign interest in the island’s property market. The regional government’s new proposals on limiting tourism property speculation will likely also have an effect in the years to come.

Navigating Future Challenges and Opportunities

As Gran Canaria and the rest of the Canary Islands adjust to the changing regulatory environment, the property market may need to realign its focus. Attracting EU-based investors and promoting affordable housing options could become more pronounced priorities. Additionally, the government’s efforts to address housing affordability through social housing initiatives and urban regeneration projects indicate a shift towards a more balanced approach to development.

In conclusion, while the abolition of the “golden visa” program represents a significant shift in Spain’s property investment landscape, Gran Canaria’s property market is poised to navigate these changes well. The island’s unique attractions, combined with a more regulated investment environment, may offer new opportunities for sustainable growth and development in the years to come.