Sources among Spanish employers have been speaking to news agency Efe, in an attempt to suggest an appropriate timetable for the reopening of some hospitality businesses, as Spain turns its hand to a phased reduction in lockdown restrictions. They have been careful to emphasise that the dates for some sort of return to business are likely to vary from Autonomous Community to Autonomous Community, depending on how badly each has been affected and the remaining risk in each region.

A Madrid entrepreneur has already started selling PVC screens for restaurants and bars in an effort to get the industry moving again. Image courtesy of LlenaTuBar.com

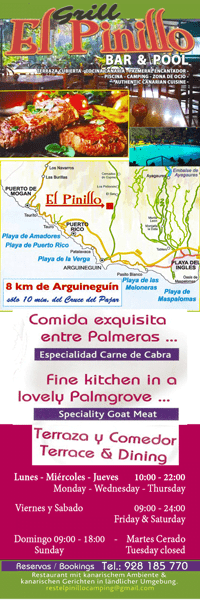

From what they have said, terraces could start operating again at some point between May 10 and 25, albeit with serious limitations on numbers of clientele, which would force each to reduce their usual capacity to a third. From May 5 they say it should be possible for customers to be once again allowed to collect pre-ordered food from the premises of hospitality businesses. And, in a third phase, from May 25, they would like to see establishments of more than 70 square meters, which provide table service, to return to normal opening, again with capacity reduced to about 33% and where they would have to use “separation measures”. None of this has yet been confirmed from government sources.

At the moment they have offered no estimates for when premises of less than 70 meters squared could reopen. Bars and restaurants throughout Spain have been closed since March 14, following the declaration of the State of Emergency, decreed by the Government in Madrid, to stop the spread of COVID-19, with the exception of licensed home delivery services.

The document prepared by an EY consultancy (members of Ernst & Young global investment firm), for the Spanish Hospitality Sector, and other employers, on the opening plan for the “post-confinement” period, specifies that the Canary Islands, Andalusia and the Valencian Community would be the regions that should first allow activity to be restored to bars and restaurants.

The study, to which Efe has had access, and which aims to serve as the basis for the proposal that the sector will make to the Executive, leaves the Balearic Islands, Murcia, Galicia, Asturias and Aragon for a “second phase”, and in a third and final phase details Madrid, Navarra, Castilla-La Mancha and Castilla y León. This list “prioritises health security over economic risk”, according to its authors, weighing variables such as the number of infected per 100,000 people, the number of deaths and the average rate of infections.

With 1.7m people, 8.8% of Spain’s workforce, directly employed, the closure of bars and restaurants is estimated to affect at least 1/3, who are at risk of reduced hours and many of losing their jobs, with more than 200,000 individuals potentially already having done so; however the fallout is expected to be much more acutely felt in The Canary Islands, who have by far the highest percentage in all Spain, with nearly a quarter of all workers directly employed by the industry, something like 3 X the national average, standing at a whopping 24.1% of all workers here on the islands directly employed in hospitality.

– The hospitality industry in Spain represents 6.2% of total GDP

– It directly employs 1.7 million people and invoices €124 billion per year

– The industry is distributed throughout the Spain’s national territories, and is a critical axis of support for tourism, another major engine of the Spanish economy

– It generates employment indirectly in several other critical sectors: food and beverage, distribution and wholesalers, among many others

• Despite its importance, the sector is particularly fragile and vulnerable to economic shocks and cycles, especially in the current crisis, because:

– It is highly fragmented and includes many small businesses: 314,000 companies; 70% of businesses have less than 3 employees

– It operates with very low profit margins – margins of 6% are typical, compared to 13% on average at the national aggregate level when you include other industries.

– It has low capitalisation levels: hospitality has a net worth of 34% vs. the 50% on average if you include other industries at the national aggregate level

– It has little liquidity: 50% of businesses have to hand just 1 month of fixed operating expenses.

All in all it paints a devastating picture for the future of the islands’ economy where a 35% loss of total GDP is possible including an 80% drop in all tourism revenues for this year and into next. With nobody yet having a clear idea of how or when tourism will begin again, it is certain that this will be one of the toughest tests the island economies will have ever had to face. A report published earlier this month by EY paints a grim picture and describes the expected impact on Spain’s hospitality sector likely to result in at least a 30-40% drop in annual revenues, as the impact continues over the coming weeks and months, in an industry that accounts for 6.2% of total GDP, one of the largest percentages in the world, when you compare the 2.8% hospitality generates for the UK economy, the 4% it accounts for in France and it represents 4.3% of the Italian economy.

A report published earlier this month by EY paints a grim picture and describes the expected impact on Spain’s hospitality sector likely to result in at least a 30-40% drop in annual revenues, as the impact continues over the coming weeks and months, in an industry that accounts for 6.2% of total GDP, one of the largest percentages in the world, when you compare the 2.8% hospitality generates for the UK economy, the 4% it accounts for in France and it represents 4.3% of the Italian economy.