Shares in travel group Thomas Cook lost most of their value this Friday seeing a near 40% drop on the London Stock Exchange, in a second consecutive day of sharp falls, after having posted losses almost six times higher than in the first quarter.

Shares in travel group Thomas Cook lost most of their value this Friday seeing a near 40% drop on the London Stock Exchange, in a second consecutive day of sharp falls, after having posted losses almost six times higher than in the first quarter.

Specifically, shares in what is one of the oldest travel companies in the world closed at 11.8 pence, their lowest level since July 2012, and approaching their highest ever daily decline since November 2011. A report from Citigroup described the shares as “worthless”, given the weak numbers of reservations for the coming summer, after Thomas Cook reported a £1.5bn loss, issuing their third ‘profit warning’ in less than a year, suggesting the uncertainty of ‘Brexit’ as a core reason behind the decline.

“Our Summer 2019 programme is 57% sold, in line with the prior year. Group Tour Operator bookings are broadly consistent with the capacity reductions we have made across our markets to better manage our operational risk throughout the year. As a result, while tour operator bookings are down 12%, pricing is up in all key segments, and 2% higher overall.We continue to see strong demand for Turkey, Egypt and Tunisia as customers are attracted by our great value offer of high-quality hotels and increased flight capacity. Bookings to the Spanish Islands are lower than last year following our decision to significantly reduce tour operator capacity for the summer.

In the UK, the political uncertainty related to Brexit over recent months has led to softer demand for summer holidays across the industry. While our booking position remains ahead of the capacity reductions in the tour operator, the trading backdrop remains highly competitive, leading to increased levels of promotional activity. We have seen no tangible change to booking patterns in recent weeks since the announcement of a delay to Brexit, although we will shortly start to lap a weaker comparative period.”

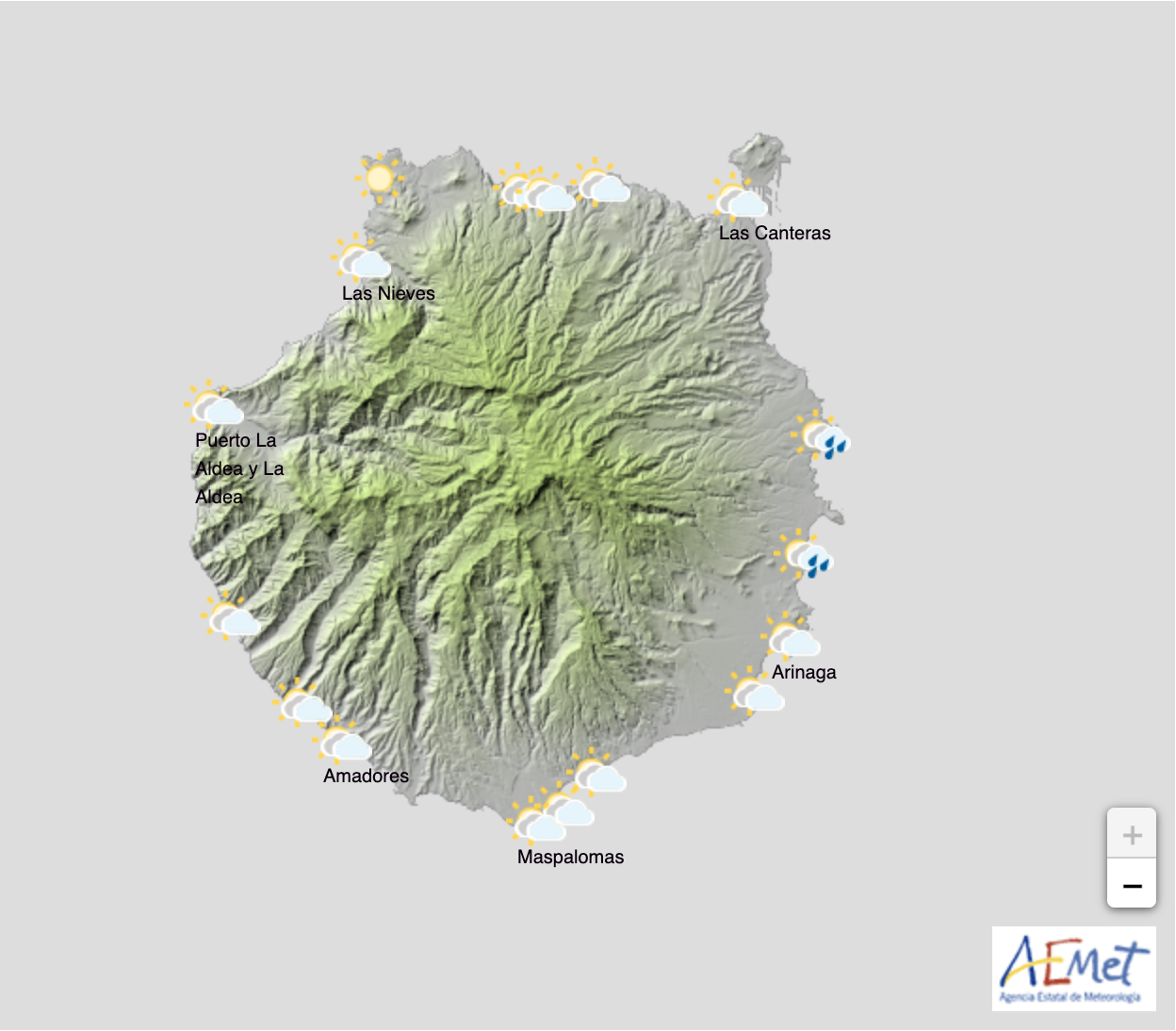

The Canary Islands is a key destination for the 178-year-old company which started by organising group trips by steam train and ship. The company has one of the world’s best-known names in travel, thanks to the inspiration and dedication of a single man, Thomas Cook. who began his international travel company on 5 July 1841, with a successful one-day rail excursion priced at a shilling a head from Leicester to Loughborough .

The Canary Islands is a key destination for the 178-year-old company which started by organising group trips by steam train and ship. The company has one of the world’s best-known names in travel, thanks to the inspiration and dedication of a single man, Thomas Cook. who began his international travel company on 5 July 1841, with a successful one-day rail excursion priced at a shilling a head from Leicester to Loughborough .

Today one of the largest and most recognisable British tour operators, Thomas Cook’s share value nosedived on Friday by as much as £120bn with talk of their now exploring the sale of what is the most profitable part of the business, the airlines, in an attempt to gain greater liquidity and sustain financing of their strategic plans to prioritise their holiday business and own-brand hotels, saying they have received “multiple offers” for the partial or total purchase of their flight arm, though no further details were available at the time of writing. Lufthansa and Virgin are both reported to be in talks with the beleaguered business.

Citigroup believes that the sale of the air business may provide short-term relief for the tourism company and could also encourage an offer for the entire company by non-EU entities such as the Chinese consortium Fosun, who are already the main shareholder in Thomas Cook.

The firm said it had only managed to sell just 57% of its summer 2019 holidays, with bookings down by as much as 12% when compared to last year. The company has slashed the number of holidays it offers in response to weakened demand, offering much bigger discounts to try and entice more UK customers into the market.

The firm said it had only managed to sell just 57% of its summer 2019 holidays, with bookings down by as much as 12% when compared to last year. The company has slashed the number of holidays it offers in response to weakened demand, offering much bigger discounts to try and entice more UK customers into the market.

Thomas Cook’s chief executive, Peter Fankhauser, said: “There is now little doubt that the Brexit process has led many UK customers to delay their holiday plans for this summer.”

Citigroup have said that the dire financial data and concerns from its auditors were likely to “unsettle consumers and drive further weakness in bookings”.

“Although the group has longstanding hotel partners that have been supportive, we fear that further weakness in the bonds/shares may also cause them to seek to tighten payment terms.”

Thomas Cook has already been dogged by debt problems since 2011, which nearly resulted in its collapse. Their shares fell by as much as 50% in a day, at one point, after it emerged that the firm was deeply engaged in emergency talks with lenders. Only after banks agreed to provide funds to keep it trading, did the tour operator manage to evade total collapse.

Should the worst happen now, holidaymakers are Atol protected, who will reimburses them for the cost of hotels and flights. The scheme is funded through a levy on all larger travel companies.