Latest Gran Canaria News, Views & Sunshine

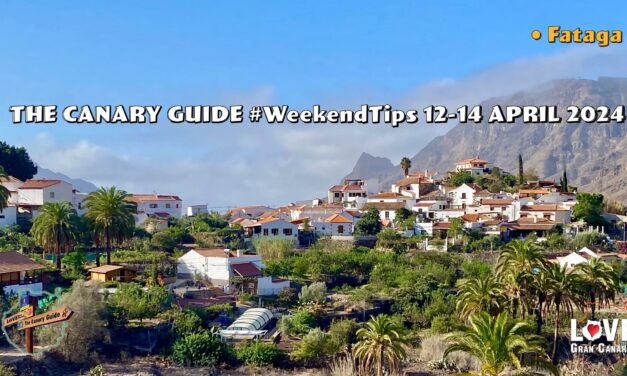

The Canary Guide #WeekendTips 12-14 April 2024

Apr, 2024 |

A warm, calima-infused weekend ahead on Gran Canaria. There is a wonderful number of events on offer including the cheese fair in Gáldar, carnival celebrations in Carrizal, The Rural Woman Fair in Fataga and patron saint festivities in the little coastal neighbourhood of El Pajar to name just a few.

Spain’s “Golden Visa” Surge Sparks Madrid Government To Announce Policy Changes

Apr, 2024 |

Recent developments may well impact those British property purchasers with more than half a million euros to spend, who were hoping to bypass many of the post-Brexit hurdles to coming to live in Spain, as the Spanish government has signaled its intention to phase out the “golden visa” program following a significant spike in the number of visas granted over the past two years. Data released by the Ministry of Housing on Tuesday highlights an increase, with 3,273 authorisations processed in 2023 up from 2,017 in 2022, with less than a thousand annually recorded in previous years. This surge represents a 230% jump from the 997 permits issued in 2021 to 2023.

Gran Canaria Expects Brief But Sizzling Spring Heatwave Hitting 35°C in the Shade

Apr, 2024 |

Gran Canaria is on the cusp of experiencing an exceptionally warm weather episode due to a warm and dry air mass of African origin that could reach 35°C in the shade. Anticipated to commence in the late hours of Tuesday the warm weather will persist for approximately a week, and temperatures forecasted to soar to unusually high levels for this time of the year, reaching up to 35°C at their peak, always measured in the shade, according to predictions from the State Meteorological Agency (AEMET). Temperatures in direct sunlight are expected to go much higher, particularly on the sunny south of the island.

The Canary Guide #WeekendTips 5-7 April 2024

Apr, 2024 |

It’s the first weekend of April and there are the monthly markets in Tejeda and La Aldea to enjoy in the spirit of eternal spring. Eleven municipalities come together this weekend in Gáldar where the ENORTE 2024 fair takes place this year. A variety of different celebrations are on offer, including two postponed from few weeks ago. A brilliant mix of warm weather and plenty to go and see and do!

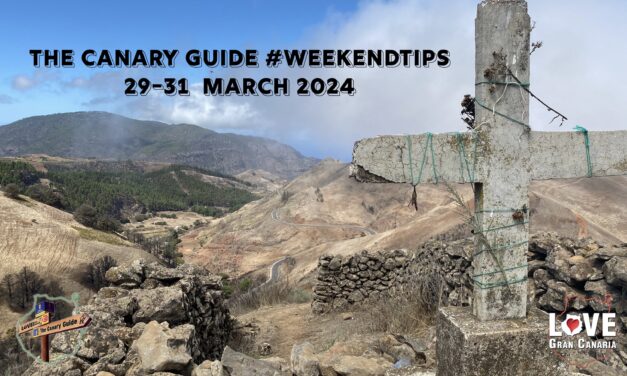

The Canary Guide Easter #WeekendTips 29-31 March 2024

Mar, 2024 |

The long easter “Puente” (bridge) weekend with Thursday and Friday both bank holidays throughout Spain. It is also the end of the christian Holy Week “Semana Santa”. There have been many traditional religious acts and processions throughout the week, with men in pointy hats, men on donkeys, and grieving mothers in their shawls, and still continuing around the island, especially in the capital until Sunday. This is going to be a tranquil weekend overall when it comes to other types of events and festivities, as easter is traditionally a time to gather the family together, visit the churches and then the beaches. The upcoming first weekend of April, however, is going to be busy busy.

- 1

- ...

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- ...

- 159

Drugs, Weapons, and Illegal Pharmaceuticals on Gran Canaria

Mar, 2024 | Mogán, News, Playa del Inglés, Tourism

In recent weeks, the Guardia Civil of Gran Canaria, in collaboration with local police forces, have conducted several operations targeting drug trafficking on the island. Two of the operations, carried out in the municipalities of Mogán and Arucas, have brought to light a small part of the ongoing efforts to combat drug-related crimes and ensure community safety. There are regular arrests and confiscations, and while all agencies do what they can, the wholesale consumption of drugs and a shady underworld on Gran Canaria persist.

The Canary Guide #WeekendTips 22-24 March 2024

Mar, 2024 | Events & Leisure, Fairs & Markets, Weekend Tips

As Spring time finally arrives, a parting shot from Winter this weekend looks to bring some interesting weather to the island. Following a warm dry winter season, rain and strong winds are in the forecast for Gran Canaria. There are many lovely events scheduled for this weekend but adverse weather conditions can cause any outdoor event to be postponed or cancelled. Easter week, Holy week, Semana Santa officially starts this Sunday with the first of the traditional religious processions.

Autopsy records accidental death as Northern Irish man named

Mar, 2024 | News

The Civil Guard on Gran Canaria has confirmed this evening autopsy results recording the death of a 32-year-old Northern Irish national, named by the Belfast Telegraph as Dean Dobbin, as an accident. The discovery of Dobbin’s body in a popular tourist complex, on the south of the island, has been met with a wave of condolences and reflections on the fragility of life. The Guardia Civil will no doubt continue with their investigation into the final hours leading up to the incident, where the man apparently suffered some form of seizure, following a few nights out, before collapsing and causing the injury that left him on the floor of the apartment in which he was staying.

#GranCanariaWeather: Spring Showers And Strong Winds as DANA (High-Level Depression) Brings Cooler Temperatures This Weekend

Mar, 2024 | Weather, Weekend Tips

As Gran Canaria and the Canary Islands prepare for a Springtime shift in weather conditions, the Spanish State Meteorological Agency (Aemet) has provided a comprehensive forecast for the coming days, indicating a departure from the warm and dry winter experienced so far this year. The latest updates warn of the trajectory of an Isolated High-Level Depression (DANA) that’s moving towards the archipelago, promising varied weather conditions across Gran Canaria. Yellow warnings are in place for coastal phenomena and winds gusting up to 70km/h in some places.

Accidental Death Suspected in Tragic Case of Tourist Found Dead in Gran Canaria Apartment

Mar, 2024 | News

The preliminary investigation, according to local sources, appears to confirm the hypothesis of an accidental death, in the case of the tourist found dead this Monday in a Puerto Rico de Gran Canaria apartment, in the southwestern municipality of Mogán.

Puerto Rico Community Saddened By Unusual Violent Death in a Tourist Apartment

Mar, 2024 | News

A holiday in the south of Gran Canaria has ended in tragedy for two friends after a 32-year-old man was found dead with a severe head wound in an apartment complex in Puerto Rico, Mogán. The Guardia Civil is handling the case, and there have been conflicting press reports about the victim’s nationality, with some sources identifying him as British and others as Irish. International press have also picked up on the story.

Investigation launched after man found dead in budget hotel room

Mar, 2024 | News

A man has died under suspicious circumstances in an apartment complex in Puerto Rico de Gran Canaria, Mogán, prompting an investigation by the Guardia Civil. The individual is believed to be a foreign national, possibly visiting the popular resort town on holiday. The incident, marked by signs of violence, allegedly involves a head injury that could suggest criminal involvement. The investigation is currently under a confidentiality order to facilitate the gathering of evidence and clarity on the event, as stated by the Guardia Civil.

The Canary Guide #WeekendTips 15-17 March 2024

Mar, 2024 | Events & Leisure, Fairs & Markets, Weekend Tips

It’s a busy, busy, busy Paddy’s Day weekend and Maspalomas is celebrating their big Carnival parade, with the annual Spring time Artisans’ Fair starting this Friday in the surroundings of Faro de Maspalomas too. There is also, among other attractions, the Big Bang Vintage Festival to enjoy at the shopping centre Las Arenas in the capital. Warm weather is on the cards with some light calima for the whole island and of course the wearing of the green for St. Patricks Day is celebrated throughout the many tourist resoprt areas this Sunday ☘️, particularly in Playa del Ingĺes and Puerto Rico de Gran Canaria.

- 1

- ...

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- ...

- 215

The Canary

News, Views & Sunshine

- Est. 2009